Life insurance is a financial product that serves a crucial role in providing security and peace of mind to individuals and their families.

It operates on the principle of safeguarding against the financial uncertainties that may arise due to the death of the insured person.

This article explores the fundamental purpose of life insurance, its types, benefits, and considerations for choosing the right policy.

Understanding Life Insurance

Life insurance is essentially a contract between an insurance policyholder (the insured) and an insurance company (the insurer).

In this agreement, the insurer promises to pay a designated sum of money (the death benefit) to a designated beneficiary upon the death of the insured person.

This financial protection helps ensure that loved ones or dependents are not financially burdened in the event of the insured’s death.

The Purpose of Life Insurance

Financial Protection for Loved Ones: One of the primary purposes of life insurance is to provide financial security to the insured’s beneficiaries after their death. This can include covering immediate expenses such as funeral costs, medical bills, and outstanding debts.

Moreover, life insurance can replace lost income to help maintain the family’s standard of living and cover future financial obligations like mortgage payments, education costs, and everyday expenses.

Debt Repayment and Estate Planning: Life insurance can be instrumental in settling debts, such as loans or mortgages, ensuring that these financial liabilities do not become a burden to surviving family members.

Additionally, it can facilitate estate planning by providing liquidity to cover estate taxes or equalize inheritances among heirs.

Business Continuation: For business owners, life insurance can serve as a vital tool in ensuring the continuity of operations in the event of a key person’s death.

It can fund buy-sell agreements, provide capital for business succession, or compensate for the loss of a key employee’s contributions to the business.

Supplemental Retirement Income: Certain types of life insurance policies, such as permanent life insurance (e.g., whole life or universal life), accumulate cash value over time.

Policyholders can access this cash value through policy loans or withdrawals, which can supplement retirement income or fund other financial needs during the insured’s lifetime.

Related: Best Life Insurance Companies: A Comprehensive Guide

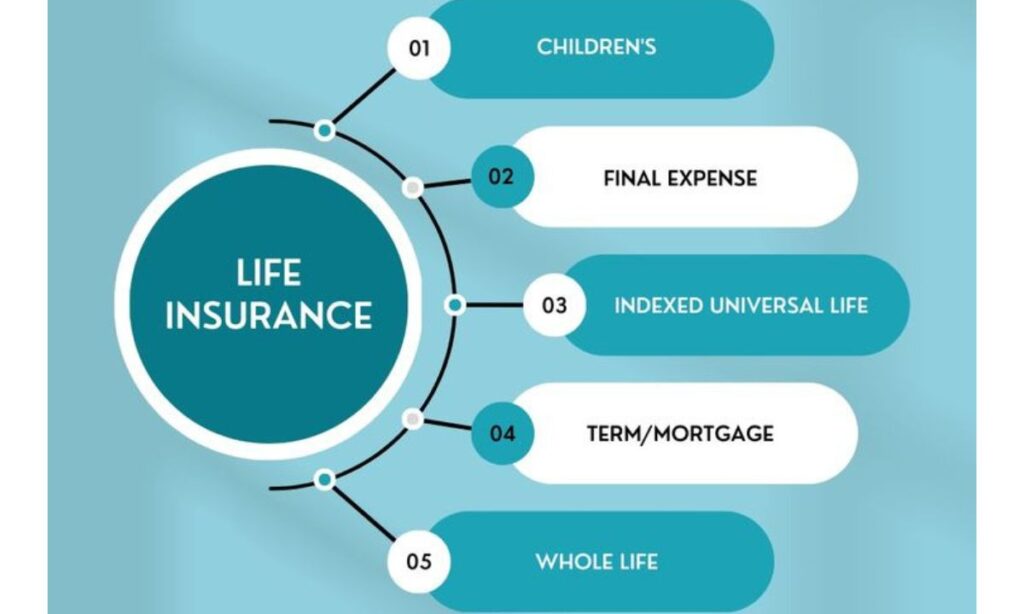

Types of Life Insurance

Life insurance policies generally fall into two main categories: term life insurance and permanent life insurance.

Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). It is typically more affordable initially and offers a death benefit if the insured passes away during the term of the policy. However, it does not accumulate cash value and premiums may increase upon renewal.

Permanent Life Insurance: Offers lifelong protection as long as premiums are paid. It includes policies like whole life and universal life, which build cash value over time.

These policies can be more expensive but offer benefits such as flexibility in premiums and the ability to accumulate tax-deferred cash value.

Benefits of Life Insurance

Financial Security: Provides a tax-free death benefit to beneficiaries, ensuring financial stability during a difficult time.

Peace of Mind: Assures policyholders that loved ones will be financially protected, regardless of unforeseen circumstances.

Estate Liquidity: Helps cover estate taxes and settlement costs, preventing the forced sale of assets.

Business Protection: Ensures business continuity and succession planning, protecting against financial loss due to the death of a key employee or partner.

Considerations When Choosing Life Insurance

When selecting a life insurance policy, several factors should be considered:

Coverage Needs: Assess the amount of coverage required to meet financial obligations and provide for loved ones.

Budget: Determine affordability and consider premium payments over the long term.

Policy Features: Understand the differences between term and permanent policies, including benefits, premiums, and flexibility.

Insurer’s Reputation: Research the financial strength and reputation of insurance companies to ensure reliability in paying claims.

Conclusion

Life insurance serves a vital purpose in providing financial security and peace of mind to individuals and their families.

By understanding the various types of life insurance policies, their benefits, and the considerations involved in choosing a policy, individuals can make informed decisions that align with their financial goals and needs.

Whether it’s protecting loved ones, ensuring business continuity, or planning for retirement, life insurance remains a cornerstone of financial planning that offers lasting benefits and security.